It’s been two and half years since I left my tenured academic job to move back to Canada and work from home as an independent educator and entrepreneur.

It’s been two and half years since I left my tenured academic job to move back to Canada and work from home as an independent educator and entrepreneur.

Lots of people ask: How’s that working out for me?

It’s been a rollercoaster for sure, but I’m still here, alive and kicking, and looking forward to 2018.

The end of the year is always a good time to take stock of one’s successes and failures over the past twelve months, think about what lessons can be learned, and chart a course for the future. So here you’ll find my “2017 Year in Review“.

I’m writing this mainly for myself, as an exercise in critical reflection that will help me identify problems, organize priorities and make positive changes in the new year. But I’m also writing for those who may be thinking of pursuing a similar path (a version of me ten years ago).

This is a lengthy document. It does tell a story from top to bottom, but to aid with navigation I’ve added a short “vital stats” section up front for those who want a quick answer to the question “how’s your business going?” (which is the polite way of asking “are you making any money?”), and a section outline with some handy links if you want to jump to individual sections.

I welcome questions and conversation in the comment section!

Outline and Quick Links

- Vital stats (link)

- Thanks and gratitude: 2017 was a transformative year for me (link)

- The Bathtub metaphor: a big picture overview of my financial situation (cash flow, sources and sinks, what financial sustainability looks like) and the risks that I’m trying to manage (link)

- Income breakdown and expenses for 2017 (link)

- Three problem areas in my business (link)

- Solutions for 2018 (link)

- Appendix: A devastating tax bill and flirting with bankruptcy (link)

1. Vital Stats

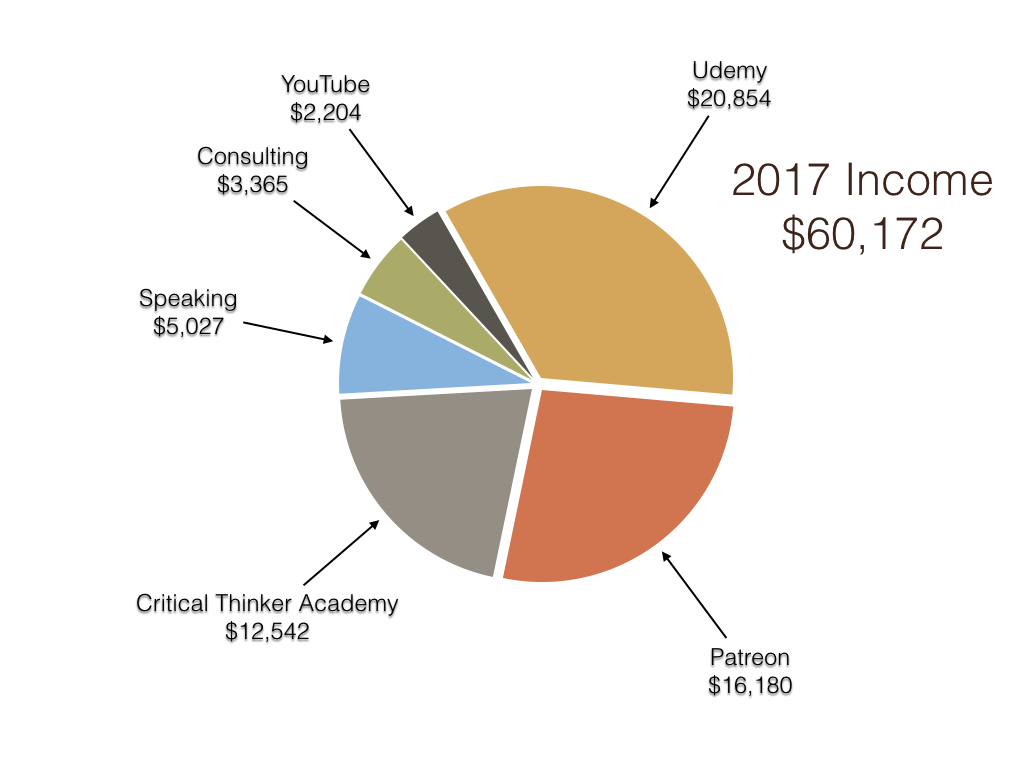

- Total Business Income in 2017: $60,172

- Compare: 2016: $25,000

- Note: I received a tax bill of $26,000 for tax year 2016

- To learn more about this, see the appendix below.

- Income Sources: % Breakdown

- Udemy: 35%

- Patreon: 27%

- Critical Thinker Academy: 21%

- Speaking: 8%

- Consulting: 6%

- YouTube: 4%

- Does average monthly income cover average monthly expenses?

- No. Closer, but expenses are still higher.

- Financially secure?

- No. Operating at a high level of personal financial risk.

- Highlights of 2017

- Finding my voice as a critical thinking educator via the Argument Ninja podcast and the Argument Ninja Academy

- Finding my Argument Ninja team: John Lenker and Julie Dirksen

- Three problem areas in my business

- Slowdown in production of public-facing content

- Fragmented online presence, fragmented audience

- Fragmented content, not optimized for problem solving

- Solutions for 2018

- Consolidate online presence, audience and content under personal hub site kevindelaplante.com

- Pursue higher paying consulting work

- Pursue higher impact and engagement with video

2. Thanks and Gratitude

It’s good to practice gratitude; it’ll add years to your life!

I’d like to offer my most heartfelt thanks to the many people who have shared their support and encouragement with me this past year. I’m especially honored and grateful to those who made a choice to support me financially. None of this would be possible without you.

In spite of many challenges I faced this year, I’ll look back on 2017 with fondness and gratitude, because it was the year that I really found my voice as a critical thinking educator.

That voice was shaped by the experience of writing and producing the Argument Ninja podcast, and especially by the support and engagement I’ve received from two people, John Lenker and Julie Dirksen, both of whom I introduced on the last podcast.

John and Julie volunteered their time and their expertise to work with me throughout the year. They pushed me to think hard about the nature of learning and skill development, and what it would take to actually build an Argument Ninja Academy, a platform that successfully teaches the skills and ideas that I talk about on the podcast. And they’ve shown me new ways of approaching these questions from a team perspective.

The work I’ve done with John and Julie has helped me to articulate what critical thinking is really about, why it’s important, and how to teach it. The old ways of teaching simply aren’t designed to handle the challenges of critical thinking in the 21st century. I understand this better and more clearly now than ever before.

I’m also grateful to be a part of an ambitious, forward-looking, aspirational project that is bigger than anything I could create on my own. It’s a great privilege to work with people who share this vision.

3. The Bathtub: A Model for Understanding My Business

To get a handle on the financial realities facing me over the past three years, here’s a helpful metaphor. It’s elementary, but my situation is just complicated enough that it’s genuinely helpful.

Imagine cash flow like the water in a bathtub. Your ongoing expenses are like the water leaving through the drain. The higher your expenses, the faster the tub drains.

Your income is the water coming into the tub from the faucet. If your income equals expenses, the water level stays constant. If expenses are great than income, the water level drops, the bathtub drains.

For the past few years I’ve received income from a handful of different sources. These are like separate faucets adding water to the tub.

i. Critical Thinker Academy

One source is the Critical Thinker Academy, my online video tutorial site. I’ve had some version of this site operating for almost ten years now. Most of the content is based on material I was teaching in my philosophy classes while working at Iowa State University.

People pay either a one-time fee or a recurring monthly fee to get access to the video content and other resources on the site.

ii. Udemy

Another source of income is from Udemy, the online video course marketplace. Udemy hosts thousands of courses by thousands of instructors.

I added a big critical thinking video course on Udemy back in 2013, approximately 12 hours of video that included most of the content I was hosting at the Critical Thinker Academy at the time.

I’ve since added a course on academic essay writing, and a course on cognitive biases. That makes three courses on Udemy. All of this content is also available at the Critical Thinker Academy site.

All of the revenue from Udemy comes from one-time sales from these courses. People pay a single (usually quite low) fee, and they get access to the video content indefinitely.

That’s my second income faucet.

iii. Patreon

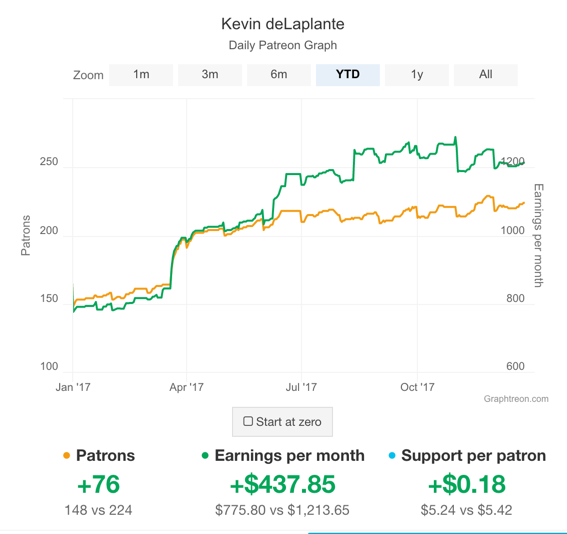

A third source of income is recurring subscriptions from Patreon subscribers.

Patreon is an online platform that makes it easy for people to offer small recurring pledges to support the work of creators they like. It’s become very popular with podcasters, artists, YouTube creators, game developers and so on.

I’ve had a Patreon page for two years, and on different occasions I’ve directed people to my Patreon page if they want to support my work financially.

I offer a big bonus for signing up with Patreon. Anyone who pledges $3/month or more gets access to all of the content at the Critical Thinker Academy site.

My Patreon support has slowly grown, and this provides another source of monthly income.

That’s a third faucet.

iv. YouTube

I have a YouTube channel with over 200 videos on it. Most of these allow YouTube to post ads on them, and collectively they generate a small amount of ad revenue on a monthly basis.

That’s a fourth faucet.

v. Speaking and Consulting

I have two sources of income that are episodic: fees for speaking invitations at conferences, and fees for miscellaneous consulting and service contracts. I may only have a few of these a year.

These aren’t regular sources of income. In our bathtub analogy they’re like occasionally pouring a bucket of water into the tub.

My Tub Has Always Been Draining

My business bathtub has always been draining. My average monthly business income has never exceeded my average monthly expenses.

Our combined living and business expenses fluctuate between $5000 and $6000 a month. That’s the rate that the bathtub drains. Multiply that by 12 months, that’s 60-70 thousand dollars a year in expenses. That’s not unusual for a family of three, living in a major city, paying tuition for a private high school for a child with learning disabilities (including dyslexia), running a largely online business … actually that’s probably low for most families in this situation.

When I was earning an academic salary, we were basically breaking even. I started out earning about $40,000 a year back in 1999. During my years as Department Chair, toward the tail end of my tenure at Iowa State University, my salary peaked just under $75,000 dollars. (Philosophy is not the most lucrative academic field.)

The stark reality of quitting your job to go solo is that you need to replace this lost income if you’re going to live sustainably. Not $1000 a month, not $2000 a month … in my case, I needed $5000 to $6000 dollars a month. Closer to $6000.

In a perfect world your side business will be earning this amount before you leave your job.

What happens more often is you start building your side income while you have a regular paying job, but it reaches a plateau, and you conclude that you really need to work on it full time if you want it to realize it’s potential.

This is a very common situation for weeknight/weekend entrepreneurs.

So you face a dilemma. Do you hold on to your job until you’ve reached your income goals from your side business? That’s safe, but how long will that take? Is it even possible?

Or do you leave your job before you’ve met those goals, but now with the freedom to work on the side business full time? That choice carries risk. Exactly how much risk depends on your living situation and how much you may have saved for this occasion. You’ll need to draw on capital of some kind to pay your bills until your business income can cover those bills.

I had a year in 2014 where I made almost $30,000 on the side, from the Critical Thinker Academy and a few speaking gigs, in addition to my $70,000 salary. That was a satisfying year. It felt like a proof of concept that this could work.

But more importantly I had a nest egg I could draw on to make up the difference. I had my retirement savings account, a university pension fund, that I’d been paying into since 1999.

With the rules governing this account, when I eventually resigned from my job I was permitted to withdraw funds from that account (minus about $20,000, which was locked away until actual retirement age). I would have to pay a hefty tax withholding charge on those funds, but I could access them.

My family was eager to move, I was ready for a new adventure, I had money to cover me for a couple of years … so I took the leap.

Update the Metaphor: Add a Second Tub Beside the Bathtub

With this retirement fund in the picture we need to update the bathtub metaphor. My bathtub has always been draining. But beside the draining bathtub is another large tub, my retirement fund.

When the water level gets low in the bathtub, I can reach into the side tub and scoop out water to periodically refill the bathtub.

That corresponds to taking a cash withdrawal from my retirement fund to keep me in the game another six to nine months.

Remember that the side tub doesn’t refill. It’s an investment vehicle, it was designed to accumulate slowly over decades. For my immediate purposes it’s basically a fixed pool that gets lower and lower with every withdrawal. And when it’s empty, that’s it.

So the end of my business runway is effectively the time remaining to drain the bathtub after I’ve transferred all the water that’s available in the side tub.

That’s the game I’ve been playing this whole time.

Those retirement fund withdrawals have been larger than I had anticipated. It cost a great deal up front to cut all ties, emigrate from the US and immigrate to Canada, finance the move, pay for a rental home, pay for my kid’s school, etc.

And daily life costs more than we had expected. We were away from Canada for sixteen years. The cost of living has gone up over that time in a city with a million people!

My Second Tub Went Dry in September 2016

I made my last withdrawal from my retirement fund in September 2016. There’s nothing more to draw. I’ve been managing the remaining water in my bathtub ever since.

I was completely panicked last fall. For various reasons my business wasn’t making much money (not much coming out of the faucets), and at the rate the bathtub was draining I estimated it would be dry by April of 2017.

Dry means you can’t pay your basic living expenses. Dry means you’ve failed.

Obviously I wasn’t going to let that happen, I’d have to make some changes before then.

That was when I produced episode 11 of the Argument Ninja podcast, which was titled “Help me Build a Candle in the Darkness”. That was the episode where I laid out the idea of building a critical thinking dojo, modeled on actual martial arts training principles.

I shared some of my financial situation on that episode, and the decisions I had to make. I said that I would need a significant jump in my recurring supporters if I was going to be able to keep producing the podcast.

I didn’t get a significant jump in supporters, but I did get a lot encouragement from fans. And that was the episode that inspired John Lenker, who I told you about in episode 23, to put up his $100/month pledge on Patreon, which ultimately launched a new chapter for me in 2017.

16 Months Later I’m Still in the Game

The fact that I’m still around indicates that I did better in 2017 than I did in 2016, and that’s true. I managed to slow the rate of drainage, to stretch out the remaining funds I had.

4. Business Income in 2017

Here’s a chart that breaks down my revenue from the different sources I reviewed above, in Canadian dollars.

In 2016 I made $25,000. In 2017 I made $60,000.

It’s always a good idea to celebrate your wins, and I consider this a win.

It’s not enough stop the tub from draining, but if my life situation was different and my expenses were lower, I could live off this income. The is the first year that I’ve made something close to a living wage working from home as a “solopreneur”. This is not a trivial achievement.

Track Your Data, See Where Your Time is Paying Off

It always pays to track your numbers and plot your data, or get someone else to do it. Until I did this I didn’t have a proper sense of the proportions in that pie chart. Once you do you can see which of your inputs are responsible for most of your outputs, and assess what’s a smart use of your time.

For example, 35% of my income this year came from sales from Udemy. It’s my biggest earner, but it’s also the sector that I spend the least amount of time on (maybe 2-3 hours per month answering questions), and that makes it extraordinarily valuable to my business. It would be insane to pull the plug on this.

Almost all of these course sales are due to Udemy’s organic search and marketing efforts, which they’re constantly refining, and the fact that my main course there has been featured as a top seller in the humanities category for a long time. You can think of it like a storefront that gets lots of foot traffic.

By contrast, until I looked at the data I would have assumed that my speaking income was higher than it was. I think this is due in part to what cognitive psychologists call the “focusing illusion”: we amplify the importance of the thing that we’re focusing our attention on.

In this case I probably spent a thousand hours this year — literally, a thousand hours — on research, development and travel activities related to just three speaking gigs: a keynote address in Toronto, a keynote address in Boston, and my two-week trip to China. And that thousand hours only earned me about $5000 total.

From a cultural enrichment standpoint the trip to China isn’t something I would try to measure in dollars and cents. But from a financial perspective this was clearly not an efficient use of my time. I shouldn’t be working for five bucks an hour.

Consider, for example, that if I had put 500 of those hours into developing a new video course for Udemy, and added it to the Critical Thinker Academy. That would have become a significant new source of ongoing, recurring revenue.

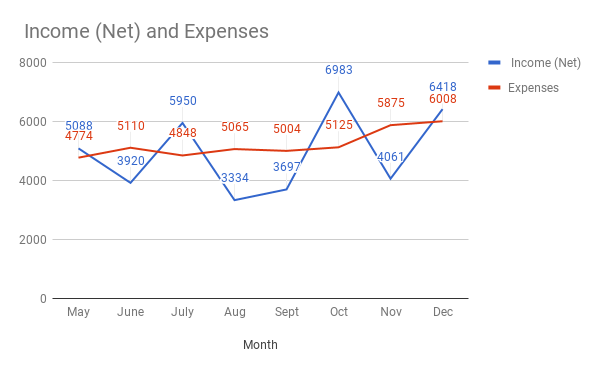

Income, Expenses and Risk

The variability of my income is also a factor that I need to pay attention to, because it’s an additional source of risk.

Here’s a graph of income (blue) and expenses (red) from May to December of 2017. You can think of the red as measuring the rate of drainage out of the bottom of the tub, and the blue as the rate of flow into the tub from my various income faucets.

Note: “Net” income is income that is deposited into my bank and PayPal accounts, after transaction and other third-party fees are deducted, but not after taxes.

It looks like our expenses are increasing; the trend line is gradually sloping up. Some of this is real. You can see the jump in November due to the additional $300 a month tax debt payment (see the appendix below for details on this).

But part of the increase is an artifact of more accurate accounting. We began paying closer attention to monthly spending this year, and it’s easy to miss idiosyncratic expenses. I started to tighten up the accounting over the last few months. The reality is that the true amount of our expenses in those earlier months is higher than what is shown — the trend line is closer to $6000 than $5000.

Our expenses are fairly consistent. What varies is the income line. The blue line is the sum of each of my income sources, each of which varies in consistency and magnitude from month to month.

My income from stable recurring sources like monthly subscriptions has always (to date) been below the red line.

When my income rises above the red line it’s because of additional inputs that are more episodic, like a one-time payment for a speaking or consulting gig, or an unusually high volume of sales on Udemy due to a marketing push (like Black Friday sales).

Whenever the blue line is below the red line, I need to draw funds from elsewhere to pay the bills.

For 2017, these funds have come from cash pools that are scattered over various banking and online accounts, like PayPal.

Those cash pools have been shrinking over the year, but the rate of shrinkage has slowed, due to new sources of income like Patreon pledges.

As of this writing, my cash pools total about $6000, which is about half what they were at the beginning of 2017.

You can see how vulnerable our situation is. A sudden medical emergency, or a major change in the operation of a third-party income generator like Udemy or Patreon, could wipe us out within a couple of months.

The upshot is that, while I’m happy to say I made $60,000 this year, I’m operating under conditions of high personal and financial risk.

And looking ahead to the new tax season, the risk is aggravated by the fact that I’m under pressure to not default on taxes.

If I have to pay $5000 in taxes out of my last $6000 in cash reserves, then the tank is really empty, and there’s no more room to dip below the red line. From that point forward my income would have to exceed that red line, every month.

To secure myself against this risk it’s clear that I need to make some changes.

5. Three Problem Areas in My Business

Here are three problem areas in my business that need to be addressed as I move forward into 2018.

Problem 1: Slowdown in Production of Public-Facing Content

One of the things I love most about the work I do also poses one of my biggest challenges as an entrepreneur.

I have TWO very different kinds of creative projects that take up most of my time, which I independently love working on. But in 2017 they didn’t contribute equally to my financial bottom line.

In fact, each seems to inhibit growth in the other.

i. Building Monthly Support Through Publication of Public-Facing Content

Because a significant portion of my income comes from small, recurring subscriptions through Patreon or the Critical Thinker Academy site, I need to provide value for this constituency.

That requires that I publish content that is public-facing and frequent enough that my supporters are reminded that they’re contributing to something that is valuable and worth maintaining.

If I really wanted to grow my Patreon audience, for example, I would need more frequent updates to public-facing channels, like Argument Ninja podcast episodes, YouTube videos, or blog posts. When updates become less frequent, supporters are more likely to cancel their pledges.

ii. Behind-the-Scenes Development on the Argument Ninja Academy

The instructional design and development work on the Argument Ninja Academy that I’ve done this year is very different. Almost all of this work is not public-facing, so my audience doesn’t see it. It’s development work that I’ve done alone or in collaboration with John and Julie.

More importantly, I don’t receive any direct financial support for the work I put into this project. The only connection to public-facing content is through the Argument Ninja podcast, where I’ve shared my vision for the Argument Ninja Academy. This may be enough to motivate some Patreon subscribers, but very few are interested in maintaining monthly support for work they can’t see.

The Problem: Splitting Time Slows Progress on Both, and Slows Growth of Recurring Revenue

In 2017 I alternated blocks of time to work on these two areas of my work, but it always felt like a win-lose game I was playing.

During months when I’m pushing myself to research, develop and publish a podcast episode or a video under a deadline, development work on the Argument Ninja Academy slowed right down. Similarly, during months when I was actively working on the Argument Ninja Academy (or other projects, like preparing for a speaking gig), I had difficulty completing a podcast episode.

With fewer podcast episodes published, and video projects stalled, it’s not surprising that recurring support would suffer. To illustrate, the graph below shows my Patreon support levels and numbers for the year.

In every monthly subscription business there’s a monthly “churn” — new subscribers join and old subscribers drop. You can see that for the second half of the year the total number of Patrons has been pretty flat, hovering around 220 supporters. I’m losing Patrons at the same rate that I’m gaining Patrons, which is not a good sign.

I owe this to the slowdown in publication of public-facing work, and the fact that I’ve had a couple of months where I’ve failed to produce new content or report significant progress on the Argument Ninja project. Out of sight out of mind.

This is in spite of the fact that I did a ton of work in 2017. The transcripts for the podcast episodes show that I’ve written over 76,000 words dedicated to podcast content. I also wrote a number of articles for the Argument Ninja website which totaled about 25,000 words.

So, just in terms of writing for the Argument Ninja podcast and website — not including the actual recording and editing of the episodes, producing videos, website updates and other related work — I wrote over 100,000 words in 2017.

That’s about the length of a manuscript for a 400 page book. I wrote the equivalent of an entire book this year.

But none of that matters to engaging an audience and motivating recurring support for your work. If your audience doesn’t have regular updates with new content, their interest and attention will fade, no matter how many hours you may be putting into your business.

***

Problem 2: My Online Presence is Fragmented

My online presence is scattered over several different web sites and platforms, with no central hub.

This results in fragmentation of my audience and difficulty building and maintaining relationships with them.

Here’s a listing of my different web properties and how they connect to my audience:

i. The Critical Thinker Academy (criticalthinkeracademy.com)

This is where I host the video tutorial courses that I started creating over 10 years ago while I was a working academic. The hosting platform is Teachable. It’s designed to make it easy for instructors to build and sell access to online courses. It’s not easily customized and not properly set up to manage other aspects of an online business (like a blog, or forms). If you’re spending time on the site it’s because you’re consuming video content.

A certain percentage of registered users are monthly recurring supporters. I don’t know how many of these are registered only to access the video content, or how many are supporting my work more generally.

I have access to the email addresses of everyone who has registered with the site. They contribute to master email list, which is hosted by ConvertKit.

ii. The Argument Ninja Podcast (argumentninja.com)

In 2017 this is where I’ve been directing people who are interested in the Argument Ninja podcast and the Argument Ninja Academy project. It’s a WordPress site. It has dedicated posts for each episode, and a collection of articles that are designed to bring viewers up to speed on my approach to critical thinking and the vision of the Argument Ninja Academy. There are very few blog posts here that are not related to the podcast.

I have email forms on this site that are connected to my master email list on ConvertKit.

iii. My Personal Site (kevindelaplante.com)

This is another WordPress site that has information about my story, my academic background, links to the Critical Thinker Academy and the Argument Ninja site, and information about my other activities, such as speaking and consulting gigs.

I originally designed this as a place to advertise my speaking services. Recently I’ve experimented with several redesigns because I now realize that this needs to be the central hub for my online presence going forward.

iv. Udemy

I have three courses on Udemy, in which there are over 25,000 students registered. Udemy has strict rules on how you can communicate with these students, and I don’t have access to their email addresses. But I can direct them to free content on any of my sites. There is a question-and-answer feature in Udemy courses that let students ask questions that I answer. I usually spend some time every week answering questions on this platform.

I don’t have any good idea how many of my registered Udemy students follow the podcast or are aware of the Argument Ninja project.

v. YouTube

I’ve had a YouTube channel for several years, which hosts sample videos from my various courses and other video projects, and the Argument Ninja podcast in video format. I have over 23,000 subscribers to this channel, but updates have become less frequent this year, and I don’t engage with the comment threads much.

vi. Facebook

I have a personal Facebook page and a “business” page called “Critical Thinker Academy”, which I set up a couple years ago. I’ve tried to keep personal and family posts separate from critical thinking posts, but haven’t always been successful. I have almost 5000 followers on the Critical Thinker Academy page.

This is where I’ve had the most success interacting with fans and supporters of my work. I share information and links here, and I post my own podcast episodes and videos here. It’s the closest thing I have to a community around my work.

Apart from name recognition, I don’t have any way of knowing what proportion of followers of the Facebook page also listen to the podcast, or are registered with the Critical Thinker Academy, or are paying supporters of any kind.

vii. Patreon

Whenever I have new content to publish I post it to Patreon along with my other channels. I have about 220 Patrons on this platform, and I have access to their emails. Unfortunately they don’t automatically integrate with my main email list manager, so I have to do that manually.

One of the major perks of becoming a Patron is gaining access to the Critical Thinker Academy video courses. Unfortunately I don’t know what proportion of people sign up primarily for this reason, and what proportion are primarily listeners and supporters of the podcast and the Argument Ninja project.

There are some advantages of having a presence across multiple platforms, but it’s clear that I’m suffering from a fragmented online identity and an audience that is scattered and difficult to reach.

***

Problem 3: I Have a Ton of Content That is Scattered and Not Optimized for Problem Solving

John Lenker recently had me do a full “content audit” across all my web properties — a listing of every podcast, every video, every article, every pdf document that I’ve produced, that is published on the Critical Thinker Academy site, the Argument Ninja site, or elsewhere.

The listing is huge, much larger than most of my supporters would appreciate since each of them only ever accesses a fraction of it.

One thing we realized is that this content isn’t easily discovered by users. If a student is interested in, say, all of the content I’ve produced that bears on topics in the philosophy of science, they would have a very hard time finding all of it because it’s not all stored in one location, and some of it is hidden away.

For example, fans of the podcast may have no idea that I have several videos on this topic over at the Critical Thinker Academy. And few may be aware that I devote twenty minutes of episode 20 of the Argument Ninja podcast to topics in the philosophy of science. It’s buried deep a one-hour episode that is ostensibly about a different subject entirely (“Critical Thinking in China”).

That’s one challenge: how to gather together the content that I have, and put it into a form that is more easily searchable and accessible.

Another issue has to do with the usefulness of the content for helping people solve the critical thinking and communication problems that they’re currently facing. Much of this content — especially the older video content in the Critical Thinker Academy — is not optimized for usefulness in this sense.

I’m talking about the bulk of the video courses that I produced while I was working as an academic philosopher. These courses focus on basic concepts in logic and argumentation, fallacies, propositional logic, probability theory, and the logic of scientific reasoning.

One of the reasons why this content is not optimized for usefulness is that at the time I was following the standard curriculum of most logic and critical thinking courses, which are dedicated to topics in “normative rationality” — theories of how human beings ought to reason.

These courses spend comparatively little time talking about how human beings in fact reason. This question belongs more to the natural and social sciences than to logic and philosophy, and the people who write critical thinking textbooks that are used in philosophy departments are generally philosophers, not psychologists or cognitive scientists. Hence the bias in the standard textbooks.

Since leaving academia and redirecting my focus to the thinking and communication problems that real people face in the real world, I’ve come to realize that the standard curriculum taught in these courses is inadequate and incomplete. This is what I’ve been striving to rectify in my work.

Please don’t misunderstand me. I’m not saying these courses are poorly done or contain information that isn’t relevant to critical thinking. On the contrary, these courses are well done, and cover many topics that should be a part of basic critical thinking literacy. Lots of people have found and continue to find great value in them.

My point is that these courses also inherit the inadequacies of the standard curricula that they’re based on. They reflect a preoccupation with questions of logic and good reasoning under idealized conditions. From a practical standpoint they don’t pay enough attention to the psychological and social realities that frustrate the efforts of real people to think critically and independently.

This is what I mean when I say that this content isn’t optimized to help people solve critical thinking problems. It’s certainly relevant to the goals of critical thinking. But the curriculum wasn’t designed with the goal of helping people address the challenges of critical thinking in the real world. This is a problem that applies to most of the educational materials that are produced for critical thinking courses.

This is a second challenge: how to assemble this content and put it into a form that is more easily applied to real world applications.

***

In my review of these three problem areas in my business there is a recurring theme: fragmentation. My web presence is fragmented, by audience is fragmented, and my content is fragmented.

It also points to a solution: consolidation. If I can consolidate my web presence and my content under one central hub, that will effectively consolidate my audience, making it easier to build relationships with and serve that audience.

6. Solutions for 2018

I. In light of the analysis of the fragmentation problem just given, I am planning to implement the following solutions:

- Consolidate my web presence and my content around my personal hub: kevindelaplante.com

- This includes the podcast content at the Argument Ninja website, and the video content at the Critical Thinker Academy

- I’ll hold on to the “argumentninja.com” url, but I won’t use it to host the podcast.

- I’d like to move off the Teachable platform for delivering my video tutorial content.

- John Lenker and I are working on a custom back-end solution to the problem of indexing, organizing and delivering my content from my personal hub.

- Consolidate my audience under a single master email list with proper segmentation and relationship funnel

- There are several distinct audiences for my content, and distinct relationships that need to be built and nurtured.

- Doing this will open up new opportunities to better serve these different audiences.

- Consolidate my recurring subscription supporters under Patreon

- I currently receive recurring payments from three different payment processors that are not integrated. This is another manifestation of the fragmentation problem.

- We can use the Patreon API to integrate membership access levels on the new personal hub site with pledge levels on Patreon.

II. It’s become clear that I won’t be able to make real progress on the Argument Ninja Academy project until I resolve my immediate funding issues. The level of personal risk is just too high and distracting.

- To this end, one solution I will be pursuing is to seek out higher-paying consulting work that has a better return on investment for my time.

III. Regarding public-facing content, in 2018 I’ll be adding a new style of YouTube video to my content production, one that puts my face on screen in a way that I haven’t done before, and integrates a hand-drawn sketchbook style of presentation. The videos will be more engaging and speak more directly to issues that are currently occupying our public conversations.

I’ve been working on this for a while. You’ll see the first videos in early January. My goal is to broaden the exposure and impact of my work, and find some new supporters.

7. Appendix: My 2017 Tax Debacle and Flirting With Bankruptcy

I’m adding this story as an appendix to this report because I don’t want a singular event to distract from the message I want to present, which is optimistic and forward-looking.

However, it’s a story that I’ve shared with my audience on Facebook, and there are valuable lessons to be learned for anyone interested in following the path of entrepreneurship.

So here goes …

***

I have to file taxes in both the US and Canada, since I still have a US green card. In 2015 I was treated as a resident of the US for tax purposes, in 2016 I was treated as a resident of Canada. Residency makes a difference to tax laws and other calculations that are hard to predict if you’re not an expert.

I wasn’t completely ignorant of tax rules going into this. I knew that early withdrawals of money from a US pension fund would be treated as income and would be taxed at the source. I knew that if I withdrew $100,000 I might only get $75,000, with the rest treated as tax paid.

I also knew that such withdrawals are treated as income for tax purposes, which can put you into a higher tax bracket than you otherwise would be, causing you to owe more money because of that.

I also knew that my business income wouldn’t be taxed at the source, so for the first time in my life I’d have to pay either in installments or after the fact.

What I didn’t think about enough was the exchange rate difference between the US and Canada, and how much higher the tax rates are in Canada.

So, for example, when I withdraw money from my US pension fund, a good percentage of money is withheld at the source, but the amount that does transfer swells once it hits my Canadian bank account due to the exchange rate. And that amount counts as income for tax purposes in Canada. And that income sets my tax bracket and the tax rate that I’ll be charged on this income.

Here’s the brutal reality that hit me in 2017:

- My business income from all sources in 2016 didn’t total more than $25,000.

- The rest of my income was from pension fund withdrawals, dipping into my side tub.

- Those pension fund withdrawals kicked me into a 40% tax bracket under Canadian tax law. If the government believes that you’re earning like a rich person, they’ll tax you like a rich person.

- Even though I had 28% of my funds withheld at the source for tax purposes, it wasn’t enough to compensate for the higher tax bracket.

- I ended up owing $26,000 in taxes to the Canadian government for 2016.

I got this news in June of 2017. Of course I couldn’t pay this. I got a phone call from a government agent asking if I could pay $2000 a month for twelve months. That was the limit of their flexibility.

Do you know what they call it when you can’t pay your debts? “Insolvent”. I was insolvent.

The first association I had in my head was “bankruptcy”. You have to declare bankruptcy when you’re insolvent, right?

Not necessarily. Bankruptcy is a radical solution to a worst case scenario. Creditors want to get as much money back as they can, so if there’s a debt payment plan that would give them more, and if they judge your financial situation to be one that can accommodate it, they’ll go for that solution.

Finding a Solution

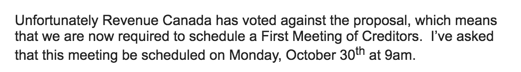

In Canada one of these lesser options is called a “consumer proposal”. But you still need to work through a licensed insolvency trustee to apply for this because it’s governed by federal law.

So in June 2017 we started this process. Part of it is doing an inventory of all your financial details going back several months — all your assets, all your income sources, all your living expenses, monthly budgets, everything. They use this information to estimate how much and how reliably you’d be able pay a monthly amount stretching over five years.

When that’s done you pick a number, say, $275 a month, and your trustee submits a proposal to your creditors, which in this case was the CRA, the Canada Revenue Agency (the Canadian version of the IRS).

To justify this number you need to make a case to your trustee that there’s room in your budget for this amount. In our case we had to show where we could cut back on our monthly expenses by this amount — dining out, groceries, household goods, and so on.

I learned that this is a negotiation between the trustee and the creditor. They can say no to this offer. If they think you can pay more, they’ll send it back, and you work out a different number, and repeat the process until they say yes. This can take weeks and months.

And this is all done remotely, you don’t actually meet face-to-face with your creditors. I didn’t realize that at first. I was expecting to walk into an office at some point and answer questions from an agent of the federal government. But that never happened.

Inferring a Narrative From a Few Numbers

One of the consequences of this remoteness is that you come to realize that all the person sees at the other end is a bunch of numbers — this is your total income, this is your tax bracket, this is what you owe, that’s it.

For the agent working in the federal government responsible for my case, I still look like a rich person who hasn’t paid their taxes. They don’t see any of the narrative that would put these numbers into some context.

I realize these tax laws weren’t designed to punish people like me. They weren’t designed to make it harder for someone in my situation to make a living. But the anonymity of the whole process makes it hard for your creditors to know what your “situation” really is.

This issue showed up in the first response from the Canadian government, which was to reject our offer of $275 a month. Here’s a portion of the email I received from my agent.

The only feedback we got with the rejection was a comment about my education expenses. They saw I was paying almost $1400 a month for high school tuition. They figured that was a luxury expense; why can’t I send my kid to a regular public high school?

In other words, the federal agent looking at my case was interpreting it as I’m a rich person who wants to send my kid to an expensive private school, and I’m not paying my taxes.

The reality is that my actual business earnings put me below the poverty line in Canada for 2016. And my kid has a collection of learning disabilities including dyslexia that regular public schools don’t accommodate very well. The private tuition is for a small high school that is designed to serve kids with special learning needs. Not what you would normally call a luxury expense.

We raised the amount of the debt payment offer to $300 a month and sent off the new proposal. But this time my agent followed up with a phone call and she talked to a federal agent directly, to explain some of the circumstances of my case.

And right away, before the day was out, they accepted the deal. A few details to put a human face on the numbers and they turned right around.

So, that issue was resolved in October 2017, and we’ve been paying the extra $300 a month since November. And we’ll be doing this for the next five years.

In the meantime, my credit rating went from excellent to bad, and it’ll stay bad for the next eight years, by law, unless somehow I can pay all this off much earlier. I can’t get a mortgage on a house now even if I wanted one.

Icing on the Cake: Three Tax Audits

My odd tax returns with these big pension withdrawals triggered tax audits across the board. I got audited by the Canadian federal government, and I got audited by the US federal and state governments. Three audits in 2016. That was not fun, I can tell you.

Moral of the story: if you can avoid getting into situations like this, do so.

The good news is that my 2017 taxes are going to be simpler, since my pension fund is empty and all I’m dealing with is my real business income.

Say, if you’re interested in becoming a financial supporter on Patreon, please click the button link below. Remember, Patrons get full access to all of the video tutorial content at the Critical Thinker Academy, AND help me stave off the darkness!

Alex

2 Jan 2018What a journey! Thanks for being so honest and open. I’ve been following you for years and I applaud your mission and work. Thousands are benefitting form your efforts. But it sounds like the situation is pretty rough. You’re working way too much for too little return.

You’re a prolific content producer. What do you think about writing a book? You should flesh out your thesis about real world vs academic rationality. That would fill a gap. That’s an evergreen source of money. It’ll take effort, but just like your Udemy course, it’s one-time and up front.

I guess the question is, what do you really want to do with yourself and your life? You’re a brilliant guy. If you wanted to optimize your work for making money, just pure money making, you could do that no doubt. The thought has crossed your mind, I’m sure, but it’s probably not appealing. Hence your choice to be an academic and then a rogue solopreneur. Nevertheless the bills gotta get paid. I hope you can find a way to stay true to your personal goals while at the same time supporting yourself and your family.

Kevin deLaplante

2 Jan 2018Thanks Alex! I don’t think I was ready for a book until this year, but a book is certainly on the agenda. I would love to write one, but first I have to fix this trade-off problem I’m currently facing, where time spent on one activity (like writing a book) hurts revenue from another. I think there’s a way to do that, but I’m getting some consulting help with this.

Alexander Chamessian

2 Jan 2018Great! I look forward to reading it.

I appreciate the way you’ve honestly and very specifically appraised your own situation. Your plan for 2018 looks solid. The breakdown of your revenue was revealing. Your three major sources are your video content at Patreon, Udemy and CTA. They are extremely high yield and from the sounds of it, you barely need to touch them.

My question is – all the other stuff. Blog posts, YouTube videos, consulting. They’re not trivial, but how much do they really help? Do you know how much traffic you get to your Big 3 sources from all the other breadcrumbs around the web? There is this urge to always be producing content, getting people’s attention. But how much does it actually help, objectively? A book is a significant, lasting project. I imagine if you just took a hiatus for like 6 months to a year, with occasional posts or videos, things wouldn’t be that much different. People would still find your stuff. Your presence is cemented on the web. That consulting stuff you did last year. 1000 hours! That could be the book already 🙂 Or half of it at least. I imagine you’re going to do less of that kind of thing in 2018.

I’m saying all this not as a critic but as someone who struggles with the problem of figuring out what is essential and important, and filtering out everything else. In the beginning of grad school, I took on way too many projects. Finishing is hard. Now I put the blinders on and work on only one or two things at once. I used to think I should be doing lots of things in parallel, but the more I examined it, the more I questioned the payoff of those things I thought I should be doing. Upon more reflection, I realized that most of what I thought would be good or high value actually isn’t.

Kevin deLaplante

2 Jan 2018Very true, it’s important to know what’s working for you and what’s not, and how the different elements interact. Recurring support, for example, feeds on regular updates of new content. If I slow down there that affects recurring support. And speaking versus consulting is very different. My ROI on speaking gigs wasn’t great (many hours), but my ROI on consulting was very high (not many hours). Devil is in the details!

Peter

2 Jan 2018Hi Kevin!

I read your post!

I really feel for you, but at the same time kind of feel that all the stuff you are going through is contributing to the genius that you are! You will get everything sorted out, I am sure!

Rome wasn’t built in a day… Don’t we know it!

I spent 236 hours on UDEMY in 2017, studying and learning 39 different topics! There is a shift happening in the way people are being educated that at some point in the near future is going to eclipse traditional school study! You are carrying a torch here, and carrying a torch can have its associated challenges! Just ask Galileo… When all your colleagues are asking WTF just happened to my job, you will be secretly smiling to yourself saying “am I ever glad that I went online when I did!” I have completed your “Master Cognitive Biases and Improve Your Critical Thinking” course on UDEMY and am currently working on “Critical Thinker Academy: Learn to Think Like a Philosopher.” I joined your website, but found everything to be somewhat overwhelming… Only my opinion, but still an opinion none the less… I think my point here is to not underestimate UDEMY! I have noticed some of the UDEMY teachers have tried to use UDEMY as a kind of advertising medium to attract students to their personal websites… I don’t really know how it is working out for them… I do know that I have never bought a course from any of those teachers’ websites because they are too expensive when compared to UDEMY’S pricing. UDEMY’S courses are priced at 10.00 US for a reason! It is because at this time that is all they are worth! Before you flip here, please hear me out! There is no real “accreditation” apart from a certificate of completion and maybe an additional certificate from the teacher at this time! It is going to take a while for UDEMY students to be recognized by “the system”, but when they are, the respect will follow! Of course the market value does not really affect the real “value” of the course in itself as I have found almost all of the courses I have taken to be “invaluable” to say the least! UDEMY is a numbers game for sure; for now! Take a look at Kain Ramsay’s profile on UDEMY! I bought 12 of his courses last year, and have completed 10 of them; some of them being almost 30 hours in length with full supplementation! Real value for my money! He even mentions about how much value he tries to pack into his courses, and he isn’t lying about it! I don’t know how much you are paying your consultants, but this one is on me my friend! UDEMY all the way! All The Best In 2018 to you Kevin! Cheers, Peter 🙂 p.s. There are some other things that I would like to say but I have gone on here long enough! Some of those things, I simply wouldn’t say here at all…

You have my eMail if you need to get touch…

Kevin deLaplante

2 Jan 2018Hi Peter, thanks for the note! One of the decisions I had to make a couple of years ago was whether to go all-in on Udemy and basically center my business around building Udemy courses (and hosting version on my own site as well). That can be a lucrative and fulfilling path. I follow a number of Udemy creators (confession: I’m registered in 64 Udemy courses), including many who are quite successful. But when I started the Argument Ninja podcast I was basically choosing to not go that route, because I was interested in exploring new approaches to teaching and learning, and building a platform that reflected those new approaches, something that I couldn’t build by myself. That’s a very different creative path.

Peter

5 Jan 2018Hi Kevin!

Cool! You have chosen a very interesting creative path!

I wish I had your energy!

Cheers, Peter

Matt

26 Jan 2018For the public facing content, have you considered hiring a content producer/researcher? Given the subject matter this might be hard to find someone for or maybe not even appropriate, but I know many bloggers that have someone to help them research and find content, write a rough outline and then they only spend a minimal amount of time putting the finishing touches on it. Do you have any older content you can recycle/update? I have made the mistake in the past of trying to do everything myself when in fact hiring help actually made me more money (even though hiring someone seemed ridiculous at the time). Any other areas that you might be able to outsource so you can focus more on the higher ROI projects?

Just some thoughts… thanks for sharing everything.

Kevin deLaplante

26 Jan 2018Hey Matt. Thanks for your thoughts! I’ve got a whole content/marketing strategy redesign going on, and I’m getting help from professionals with an excellent track record. I’ll be sharing developments along this front as we move into 2018.